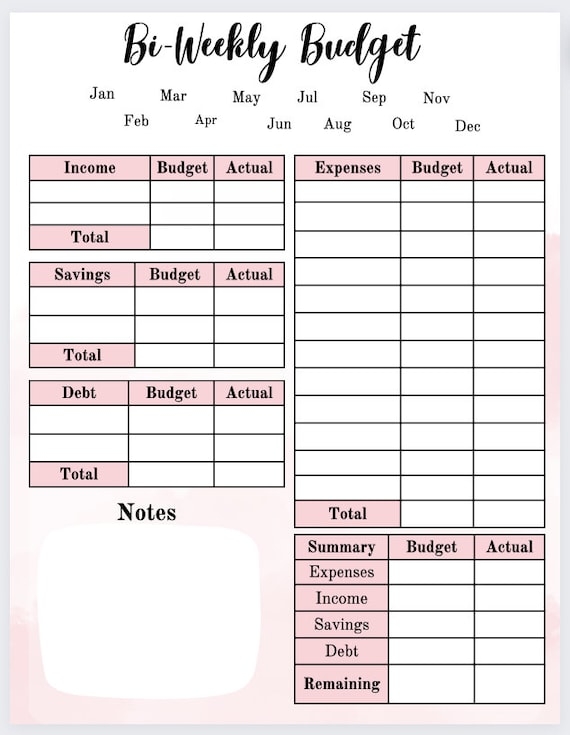

Managing finances can be overwhelming, but creating a biweekly budget worksheet can help you stay organized and on track with your spending. With the use of a printable worksheet, you can easily monitor your income and expenses, allowing you to make more informed financial decisions.

By utilizing a biweekly budget worksheet, you can allocate your funds towards essential expenses such as rent, groceries, and utilities, while also setting aside money for savings and discretionary spending. This tool can provide a clear overview of your financial situation and help you identify areas where you may need to cut back on spending.

One key benefit of using a biweekly budget worksheet is that it allows you to track your spending patterns over time. By consistently updating the worksheet with your income and expenses, you can gain insight into where your money is going and make adjustments as needed. This can help you achieve your financial goals and improve your overall financial health.

Additionally, a biweekly budget worksheet can help you plan for future expenses, such as vacations, home repairs, or large purchases. By setting aside money in advance for these expenses, you can avoid going into debt or dipping into your savings unexpectedly. This proactive approach to budgeting can provide peace of mind and help you better manage your finances.

In conclusion, utilizing a biweekly budget worksheet printable can be a valuable tool in helping you manage your finances effectively. By tracking your income and expenses, setting financial goals, and planning for future expenses, you can take control of your financial situation and work towards a more secure financial future. Download a biweekly budget worksheet printable today and start taking charge of your finances.