When it comes to taxes and deductions, navigating the various forms and worksheets can be overwhelming. One important form to be aware of is the Credit Limit Worksheet 8863, which is used to calculate education credits for qualified expenses. Understanding this worksheet can help you maximize your tax benefits and ensure accuracy in your tax filing.

The Credit Limit Worksheet 8863 is a crucial tool for individuals claiming education credits on their tax return. It helps determine the maximum amount of credit that can be claimed based on qualified expenses paid for higher education. By carefully filling out this worksheet, taxpayers can ensure they are claiming the correct amount of credits and potentially reduce their tax liability.

Understanding the Credit Limit Worksheet 8863

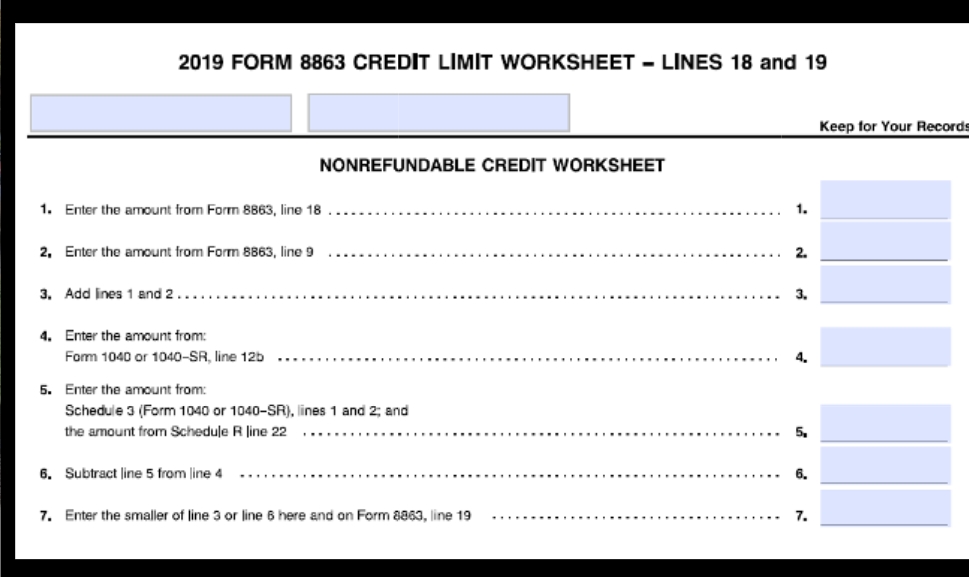

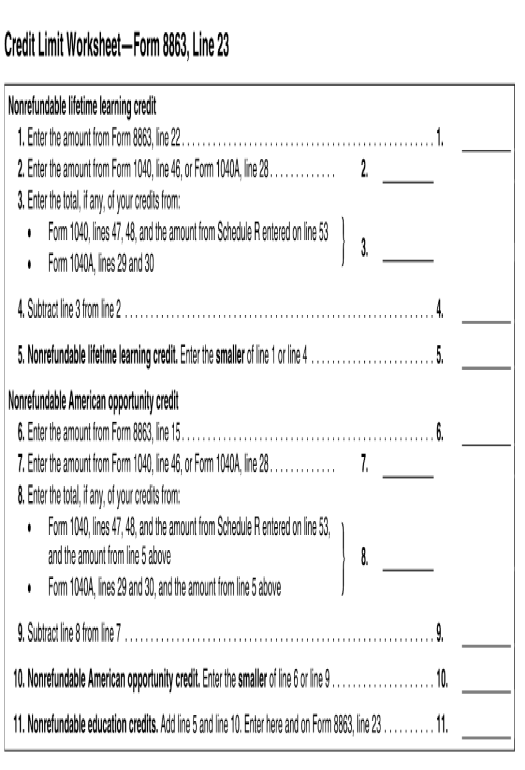

When completing the Credit Limit Worksheet 8863, taxpayers must first calculate the amount of their adjusted qualified education expenses. These expenses include tuition, fees, and course materials required for enrollment or attendance at an eligible educational institution. Once the total expenses are determined, taxpayers can then calculate the education credit for which they qualify.

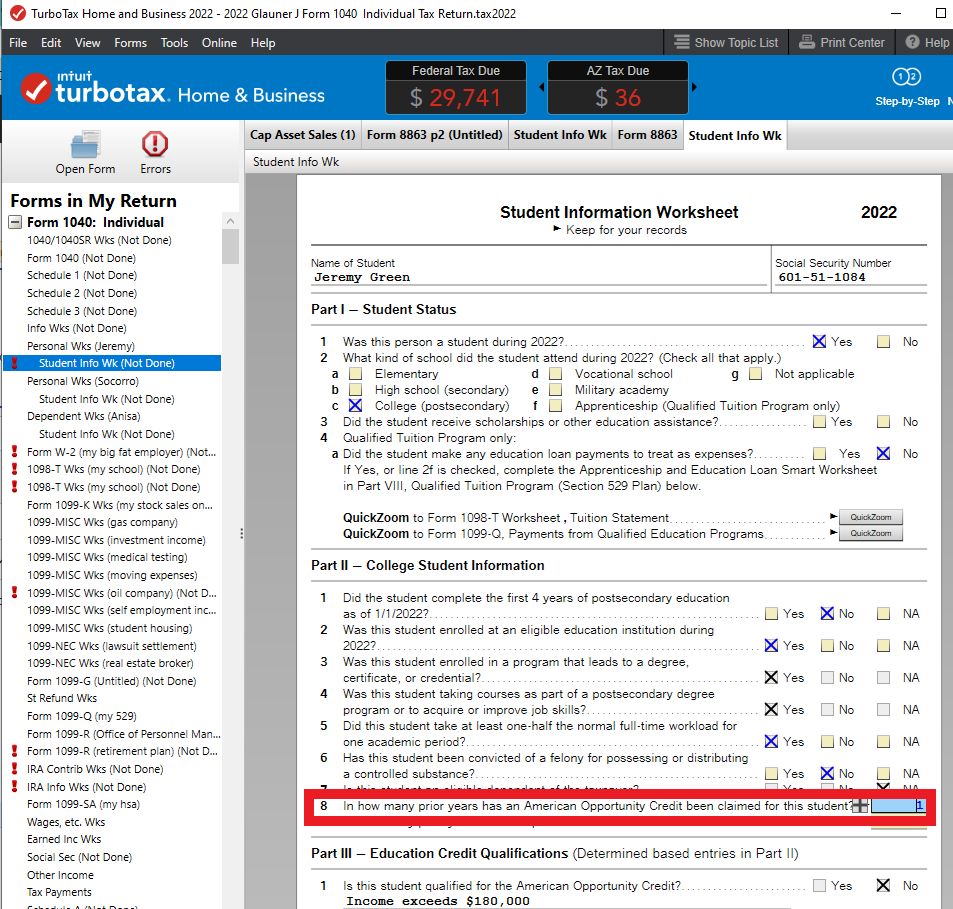

In addition to calculating education credits, the Credit Limit Worksheet 8863 also helps determine any limitations on the amount of credit that can be claimed. These limitations are based on factors such as the taxpayer’s filing status, modified adjusted gross income, and the number of eligible students in the household. By carefully following the instructions on the worksheet, taxpayers can ensure they are claiming the correct amount of credit without exceeding the allowable limits.

It is important to note that the information provided on the Credit Limit Worksheet 8863 must be accurate and supported by documentation, such as receipts and school records. Any inaccuracies or discrepancies could result in delays in processing your tax return or even trigger an audit by the IRS. Therefore, it is essential to double-check your calculations and ensure all required information is included before submitting your tax return.

In conclusion, the Credit Limit Worksheet 8863 plays a vital role in determining education credits for qualified expenses. By understanding how to properly fill out this worksheet and following the instructions carefully, taxpayers can maximize their tax benefits and avoid potential errors in their tax filing. If you have any questions or need assistance with completing the Credit Limit Worksheet 8863, consider consulting a tax professional for guidance.