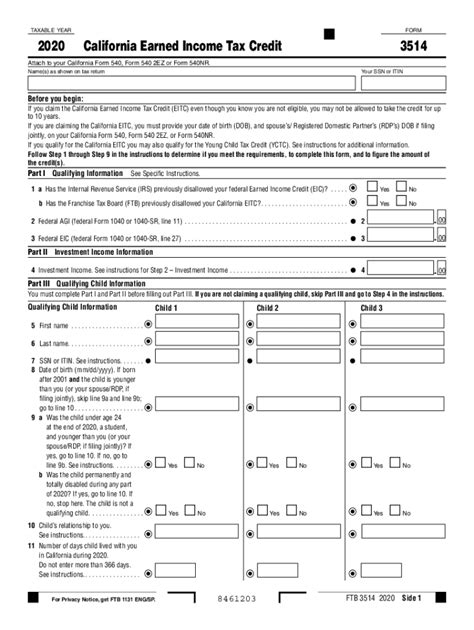

The Earned Income Tax Credit (EITC) is a valuable tax credit for low to moderate-income individuals and families. It helps to reduce the amount of taxes owed and can even result in a refund. In order to determine eligibility for the EITC and calculate the credit amount, taxpayers must complete the EITC worksheet.

The EITC worksheet is a crucial tool in the process of claiming the Earned Income Tax Credit. It helps taxpayers determine if they qualify for the credit and calculate the amount they may be eligible to receive. The worksheet takes into account various factors such as earned income, investment income, filing status, and number of qualifying children.

By following the instructions on the EITC worksheet, taxpayers can accurately determine their eligibility and ensure that they claim the correct amount of the credit. It is important to fill out the worksheet carefully and double-check all calculations to avoid errors or potential delays in receiving the EITC refund.

For taxpayers with qualifying children, the EITC worksheet includes additional calculations to determine the amount of the credit based on the number of children and their ages. The worksheet also helps to ensure that taxpayers claim all available credits and deductions in order to maximize their tax refund.

Completing the EITC worksheet may seem daunting at first, but with careful attention to detail and following the instructions provided, taxpayers can accurately determine their eligibility for the credit. The EITC can provide significant financial assistance to eligible individuals and families, making it well worth the effort to complete the worksheet accurately.

In conclusion, the EITC worksheet is a valuable tool for low to moderate-income taxpayers to determine their eligibility for the Earned Income Tax Credit. By carefully completing the worksheet and following the instructions provided, taxpayers can ensure that they claim the correct amount of the credit and receive the maximum refund possible. It is important to take the time to fill out the EITC worksheet accurately to avoid potential errors and delays in receiving the credit.