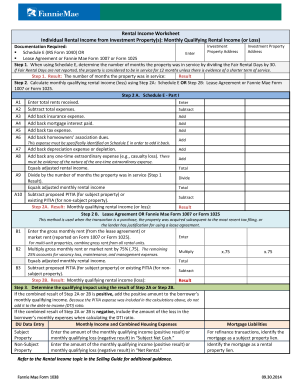

When it comes to obtaining a mortgage for an investment property, lenders often require borrowers to provide detailed information about their rental income. This is where the Fannie Rental Income Worksheet comes into play. This worksheet is a crucial tool used by lenders to evaluate the potential rental income of a property and determine if it is sufficient to cover the expenses associated with the mortgage.

The Fannie Rental Income Worksheet helps lenders calculate the net rental income from an investment property by taking into account factors such as vacancy rates, maintenance costs, and property taxes. This information is essential for lenders to assess the risk associated with lending to a borrower and ensure that the rental income is stable and reliable.

Factors Considered in Fannie Rental Income Worksheet

One of the key factors considered in the Fannie Rental Income Worksheet is the estimated rental income of the property. Borrowers are required to provide documentation such as lease agreements, rental histories, and market analyses to support their rental income estimates. Lenders also take into account the location of the property, market trends, and the condition of the property when evaluating the rental income.

In addition to rental income, the Fannie Rental Income Worksheet also considers expenses related to the property, such as property taxes, insurance, maintenance costs, and property management fees. These expenses are subtracted from the rental income to calculate the net rental income, which is used to determine the borrower’s ability to cover the expenses associated with the mortgage.

Another important factor in the Fannie Rental Income Worksheet is the vacancy rate of the property. Lenders typically require borrowers to account for potential vacancies when estimating rental income to ensure that there is a buffer to cover periods of vacancy and maintain a steady cash flow. By considering all of these factors, lenders can make an informed decision about lending to a borrower and mitigate the risk of default.

In conclusion, the Fannie Rental Income Worksheet is a valuable tool used by lenders to evaluate the potential rental income of an investment property and assess the borrower’s ability to cover the expenses associated with the mortgage. By providing accurate and detailed information on rental income, expenses, and vacancy rates, borrowers can increase their chances of obtaining a mortgage for an investment property.