Managing finances can be challenging for college students, especially when balancing tuition, books, rent, and other expenses. One helpful tool for staying on track with spending is a printable budget worksheet. These worksheets can help students keep track of their income, expenses, and savings goals, making it easier to stay within a budget and avoid unnecessary debt.

Creating a budget is an essential skill for college students to learn early on, as it sets the foundation for financial responsibility in the future. By using a printable budget worksheet, students can visualize their financial situation, identify areas where they may be overspending, and make adjustments to reach their financial goals.

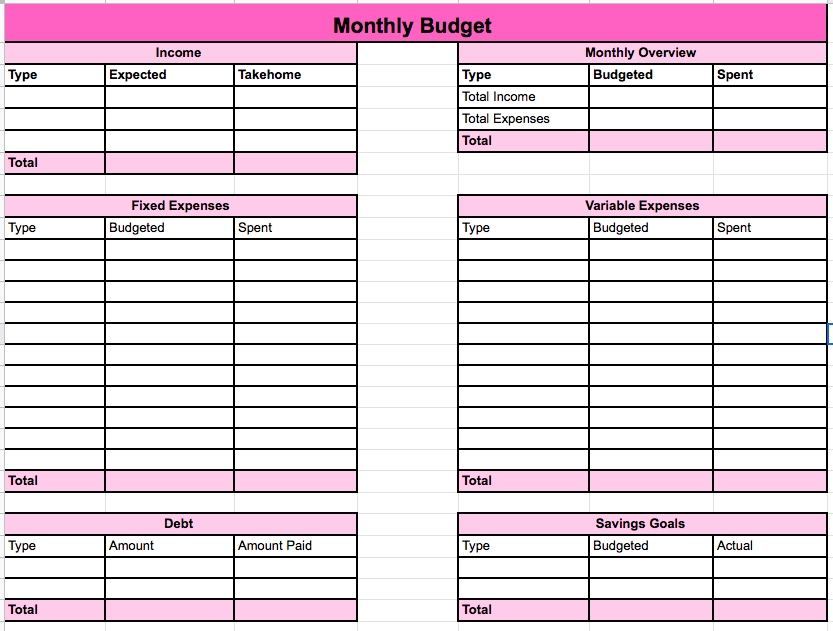

There are many different printable budget worksheets available online that cater specifically to college students. These worksheets typically include categories such as income sources, fixed expenses (such as rent and utilities), variable expenses (such as groceries and entertainment), savings goals, and a section for tracking actual spending. By filling out these worksheets regularly, students can see where their money is going and make informed decisions about their finances.

One key benefit of using a printable budget worksheet is that it promotes accountability and discipline when it comes to spending. By tracking expenses and comparing them to a budget, students can see where they may need to cut back or reallocate funds to meet their financial goals. This awareness can help students avoid overspending, build savings, and develop good financial habits for the future.

In conclusion, a printable budget worksheet is a valuable tool for college students to manage their finances effectively. By using these worksheets to track income, expenses, and savings goals, students can stay on top of their finances and make informed decisions about their spending. With discipline and accountability, college students can build a solid financial foundation that will serve them well beyond their college years.