As senior citizens enter retirement, managing finances becomes even more crucial. With a fixed income, it’s important to have a clear budget in place to ensure that expenses are covered while still being able to enjoy a comfortable lifestyle. One helpful tool for seniors to stay on top of their finances is a printable budget worksheet.

These worksheets are designed to help seniors track their income, expenses, and savings in an organized manner. By having a visual representation of their financial situation, seniors can make informed decisions about their spending and saving habits.

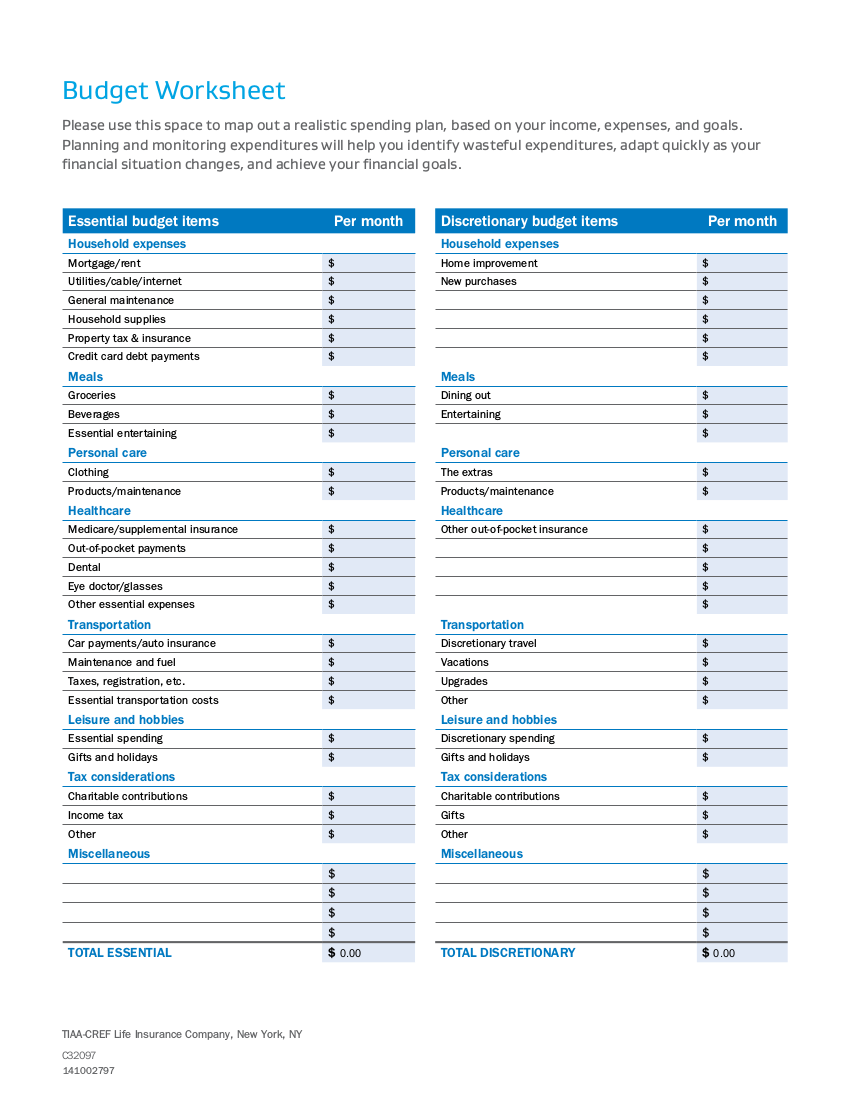

One popular free printable budget worksheet for senior citizens is the “Senior Budget Planner” template. This worksheet includes sections for income sources, monthly expenses, savings goals, and a summary of total income and expenses. By filling out this worksheet each month, seniors can easily see where their money is going and make adjustments as needed.

Another helpful budget worksheet is the “Retirement Budget Worksheet,” which focuses on expenses that are specific to retirees, such as healthcare costs, travel expenses, and leisure activities. This worksheet allows seniors to prioritize their spending based on their retirement goals and lifestyle preferences.

For seniors who prefer a more customizable budgeting tool, there are also online resources that offer free budget templates that can be tailored to individual needs. These templates often include features such as expense tracking, budget forecasting, and goal setting to help seniors stay on track with their financial goals.

In conclusion, a printable budget worksheet can be a valuable tool for senior citizens looking to manage their finances effectively during retirement. By using these worksheets to track income and expenses, seniors can gain a better understanding of their financial situation and make informed decisions about their spending habits. With the help of these budgeting tools, seniors can enjoy a worry-free retirement while still being able to afford the things they love.