When it comes to managing your finances, it’s crucial to ensure that you’re paying the right amount of taxes. One way to do this is by accurately filling out the NC-4 Allowance Worksheet. This worksheet helps determine how much state income tax should be withheld from your paycheck based on your filing status, income, and deductions.

By completing the NC-4 Allowance Worksheet, you can avoid overpaying or underpaying your state income tax. This can help prevent any surprises come tax time and ensure that you’re not left with a hefty tax bill that you weren’t prepared for.

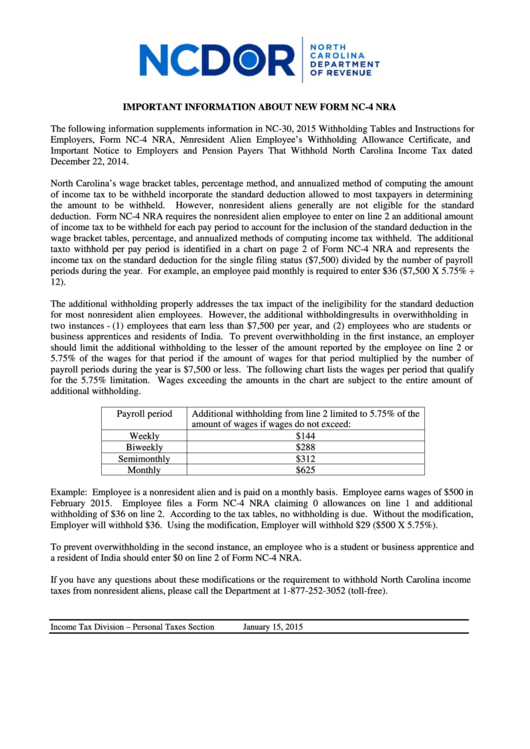

NC-4 Allowance Worksheet

The NC-4 Allowance Worksheet typically consists of several sections that require you to provide information such as your filing status, number of dependents, and any additional income or deductions. By accurately filling out this worksheet, you can calculate the correct number of allowances to claim on your W-4 form, which in turn determines how much state income tax will be withheld from your paycheck.

It’s important to review and update your NC-4 Allowance Worksheet regularly, especially if there are any changes in your financial situation such as getting married, having children, or changing jobs. By keeping this worksheet up to date, you can ensure that you’re withholding the correct amount of state income tax throughout the year.

Additionally, if you find that you’re consistently receiving a large tax refund or owing a significant amount come tax time, it may be a sign that you need to adjust the number of allowances you’re claiming on your W-4 form. The NC-4 Allowance Worksheet can help you determine the appropriate number of allowances to claim based on your individual circumstances.

In conclusion, the NC-4 Allowance Worksheet is a valuable tool in managing your state income tax withholding. By accurately completing this worksheet and updating it as needed, you can ensure that you’re paying the right amount of taxes throughout the year. This can help prevent any financial surprises and ensure that you’re in good standing with the tax authorities.