Managing your finances can be a daunting task, but with the help of a printable budget planning worksheet, you can easily keep track of your expenses and savings. A budget plan is essential for achieving your financial goals and staying on top of your financial health.

By using a printable budget planning worksheet, you can visualize your income and expenses in a clear and organized manner. This tool allows you to allocate funds for different categories such as bills, groceries, entertainment, and savings, helping you prioritize your spending and identify areas where you can cut back.

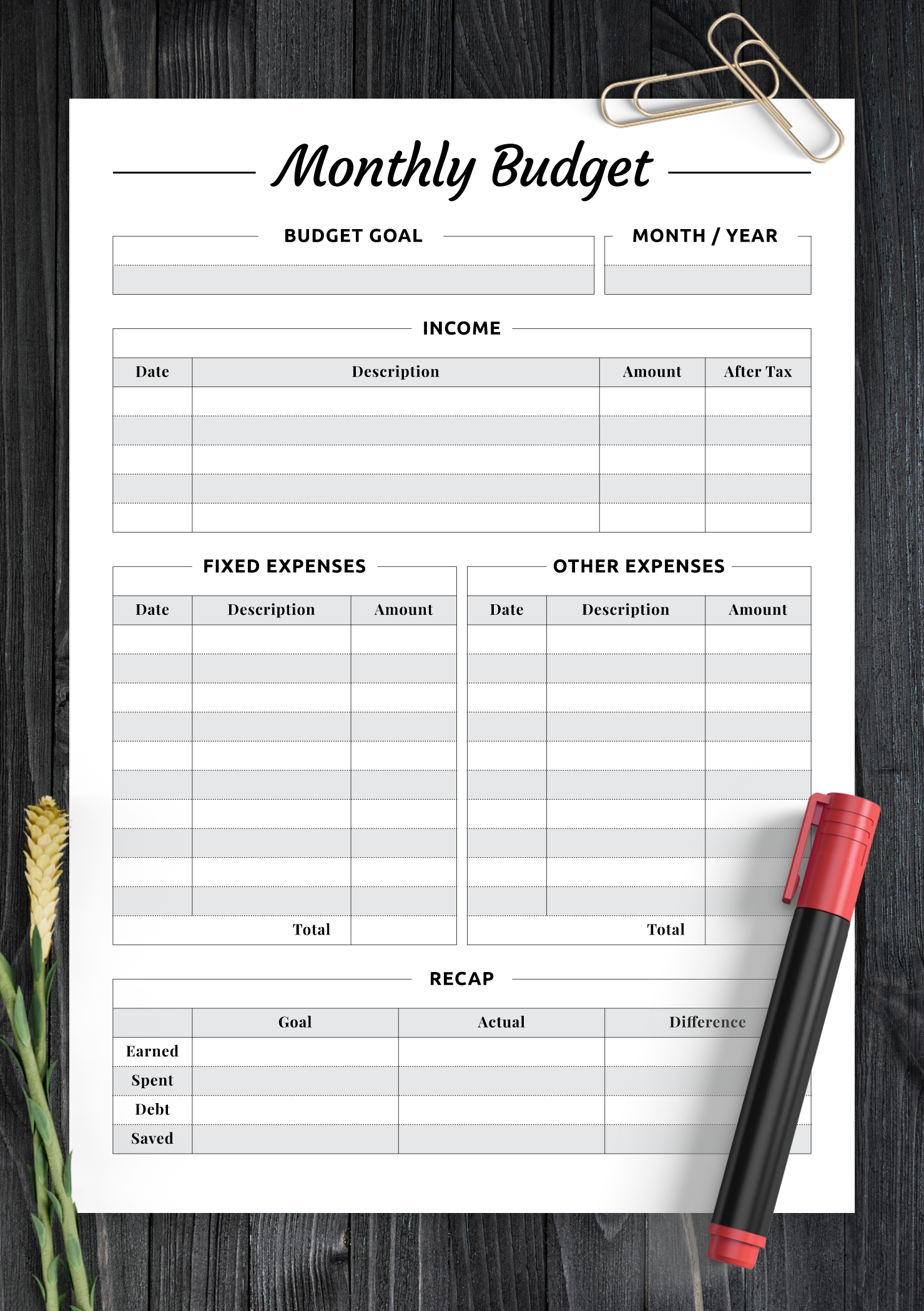

Printable Budget Planning Worksheet

There are many free printable budget planning worksheets available online that you can download and customize to fit your specific financial situation. These worksheets typically include sections for income, expenses, savings goals, and a summary of your overall budget.

Start by listing all your sources of income, including your salary, bonuses, and any other sources of revenue. Next, track your monthly expenses such as rent, utilities, groceries, transportation, and entertainment. Be sure to include both fixed expenses (those that remain constant each month) and variable expenses (those that fluctuate).

Once you have listed all your income and expenses, calculate your total income and subtract your total expenses to determine your savings or deficit. If you find that you are spending more than you are earning, look for areas where you can cut back on expenses or increase your income. Setting savings goals can also help you stay motivated and disciplined in your budgeting efforts.

Regularly updating your budget planning worksheet and monitoring your spending habits is key to maintaining financial stability. Review your budget on a monthly basis to track your progress, make adjustments as needed, and ensure that you are staying on track with your financial goals.

In conclusion, using a printable budget planning worksheet is a practical and effective way to manage your finances and achieve your financial goals. By creating a budget plan and tracking your income and expenses, you can make informed decisions about your spending and savings, ultimately leading to improved financial health and peace of mind.