When it comes to taxes, understanding the different types of income and how they are taxed is essential. Qualified dividends and capital gains are two types of income that can have favorable tax treatment, but it’s important to know how to calculate and report them correctly on your tax return. The Qualified Dividends and Capital Gains Worksheet for 2024 is a tool that can help you determine the amount of tax you owe on these types of income.

Qualified dividends are dividends received from a domestic corporation or qualified foreign corporation that meet certain criteria set by the IRS. These dividends are taxed at the capital gains tax rates, which are typically lower than ordinary income tax rates. Capital gains, on the other hand, are the profits you make from selling assets like stocks, bonds, or real estate. Like qualified dividends, capital gains are also taxed at lower rates than ordinary income.

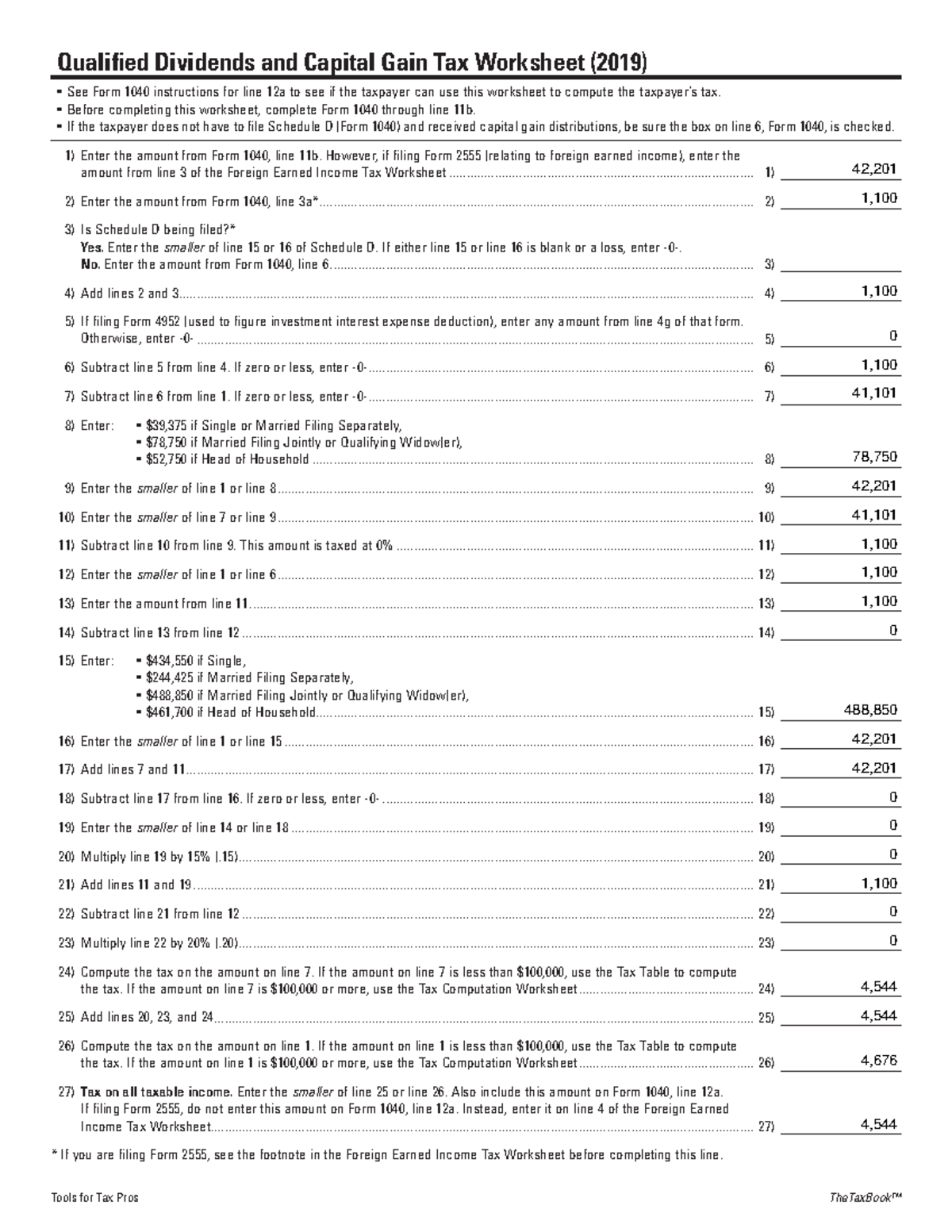

Qualified Dividends and Capital Gains Worksheet 2024

The Qualified Dividends and Capital Gains Worksheet for 2024 is used to calculate the tax on qualified dividends and capital gains based on your filing status and total income. The worksheet takes into account any adjustments, deductions, and credits that may apply to your tax situation. By following the instructions on the worksheet, you can determine the amount of tax you owe on these types of income and ensure that you are paying the correct amount to the IRS.

When completing the worksheet, you will need to gather information about your qualified dividends and capital gains, as well as any other income you have received throughout the year. You will then follow the step-by-step instructions to calculate the tax on these types of income, taking into consideration any applicable tax rates and limits. By using the worksheet, you can avoid errors in your tax calculations and potentially reduce the amount of tax you owe.

It’s important to note that the tax rates for qualified dividends and capital gains can vary depending on your filing status and total income. By using the Qualified Dividends and Capital Gains Worksheet for 2024, you can ensure that you are taking advantage of the lower tax rates available for these types of income and accurately report them on your tax return.

In conclusion, understanding how to calculate and report qualified dividends and capital gains is crucial for minimizing your tax liability. By using the Qualified Dividends and Capital Gains Worksheet for 2024, you can accurately determine the amount of tax you owe on these types of income and ensure that you are compliant with IRS regulations. Make sure to consult with a tax professional if you have any questions or need assistance with completing the worksheet.