Managing rental properties can be a lucrative endeavor, but it also comes with its fair share of responsibilities. Keeping track of rental income and expenses is crucial for efficient financial management. One of the best tools for this task is a rental income and expense worksheet in Excel. This versatile spreadsheet program allows landlords to easily input and track their income and expenses, helping them stay organized and make informed financial decisions.

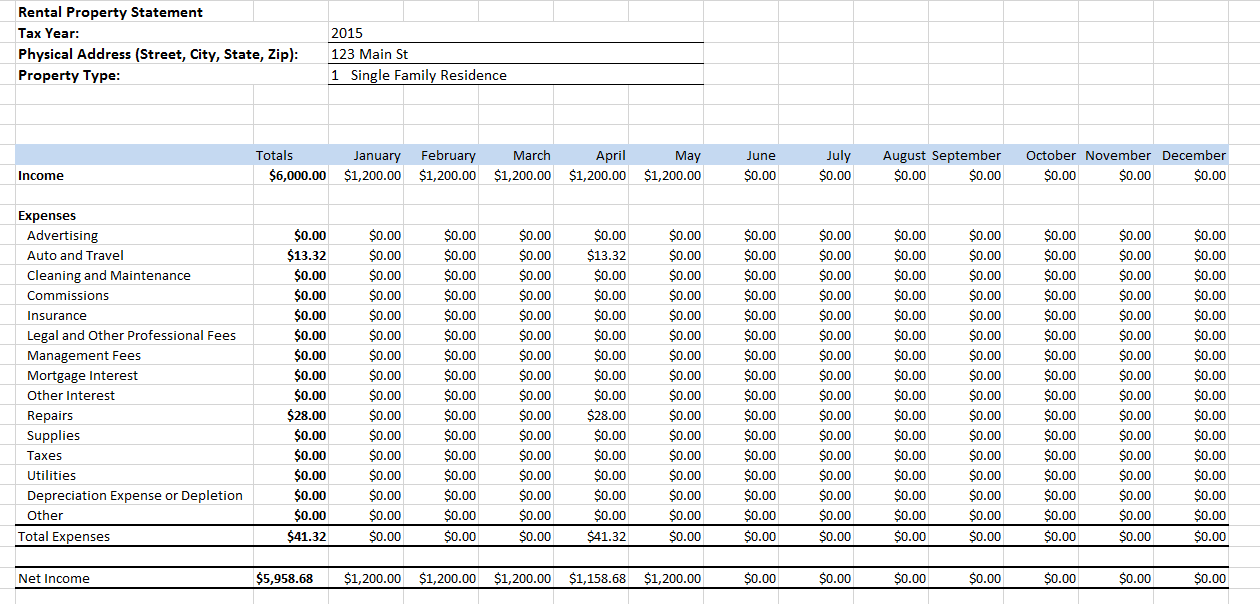

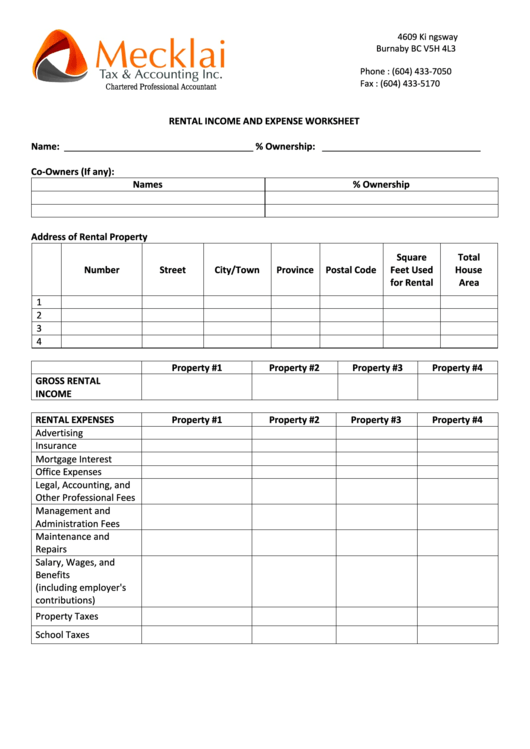

With a rental income and expense worksheet in Excel, landlords can easily track and categorize their income sources, such as rent payments, security deposits, and late fees. This allows them to see at a glance how much income they are generating from their rental properties. They can also input and track their expenses, such as mortgage payments, property taxes, maintenance costs, and utilities. By organizing and categorizing these expenses, landlords can get a clear picture of their financial health and make adjustments as needed.

One of the key benefits of using Excel for rental income and expense tracking is its flexibility. Landlords can customize their worksheets to suit their specific needs and preferences. They can add or remove columns, create formulas for automatic calculations, and even color-code different categories for easy identification. This level of customization allows landlords to create a personalized financial management system that works best for them.

Another advantage of using Excel for rental income and expense tracking is its ability to generate detailed reports and summaries. Landlords can easily create monthly or yearly income statements, expense reports, and profit and loss statements with just a few clicks. These reports provide valuable insights into the financial performance of their rental properties, helping them make informed decisions about pricing, budgeting, and investment strategies.

In conclusion, a rental income and expense worksheet in Excel is a valuable tool for landlords looking to streamline their financial management processes. By tracking their income and expenses in a structured and organized manner, landlords can gain better control over their finances and make more informed decisions about their rental properties. With its flexibility, customization options, and reporting capabilities, Excel is an ideal solution for landlords seeking to optimize their financial management practices.