As you approach retirement age, it’s important to understand the rules and regulations surrounding required minimum distributions (RMDs) from your retirement accounts. One key tool in calculating your RMD is the worksheet provided by the IRS. This worksheet helps you determine the amount you must withdraw from your retirement accounts each year to avoid penalties.

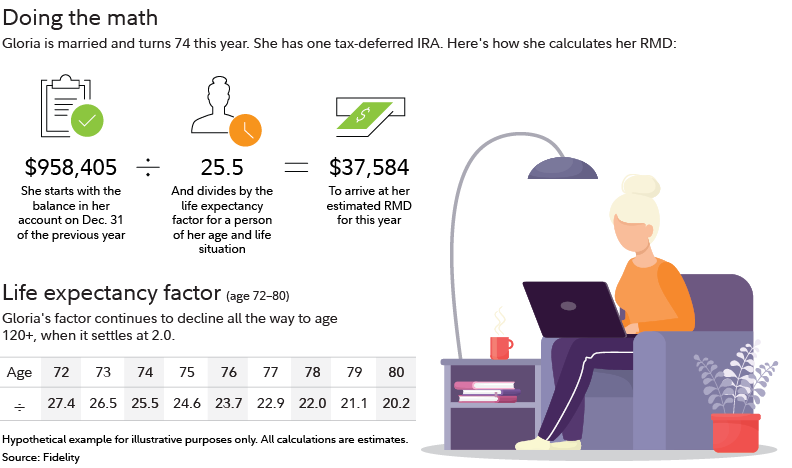

Calculating your RMD can be complex, as it depends on factors such as your age, account balance, and life expectancy. However, the IRS provides a worksheet to simplify the process and ensure you are meeting the required distribution amounts.

Required Minimum Distribution Worksheet

The RMD worksheet typically includes sections for entering your age, account balance, and other relevant information. By following the instructions on the worksheet, you can calculate the amount you are required to withdraw from your retirement accounts each year. This ensures that you are in compliance with IRS regulations and avoid penalties for failing to take your RMD.

It’s important to note that the RMD rules vary depending on the type of retirement account you have, such as traditional IRAs, 401(k)s, and other qualified plans. Each account may have different requirements for calculating and taking your RMD, so it’s essential to consult with a financial advisor or tax professional to ensure you are following the rules correctly.

Failure to take your RMD can result in significant penalties, including a 50% excise tax on the amount you should have withdrawn. By using the RMD worksheet and staying informed about the rules and regulations, you can avoid costly mistakes and ensure you are maximizing your retirement savings.

In conclusion, the required minimum distribution worksheet is a valuable tool for retirees to calculate the amount they must withdraw from their retirement accounts each year. By understanding the rules and using the worksheet provided by the IRS, you can ensure you are in compliance with regulations and avoid penalties. Consult with a financial professional to help you navigate the complexities of RMDs and make the most of your retirement savings.