Managing finances can be a daunting task, especially when it comes to reporting capital gains and losses on your tax return. The Schedule D Worksheet is a crucial document that helps individuals calculate and report these gains and losses accurately. Understanding how to fill out this worksheet correctly can save you time and prevent any potential errors that could lead to audits or penalties.

Whether you’re a seasoned investor or new to the world of investing, the Schedule D Worksheet is an essential tool that can help you navigate the complexities of reporting your capital gains and losses. By following the guidelines outlined in this worksheet, you can ensure that you comply with tax laws and accurately report your investment income.

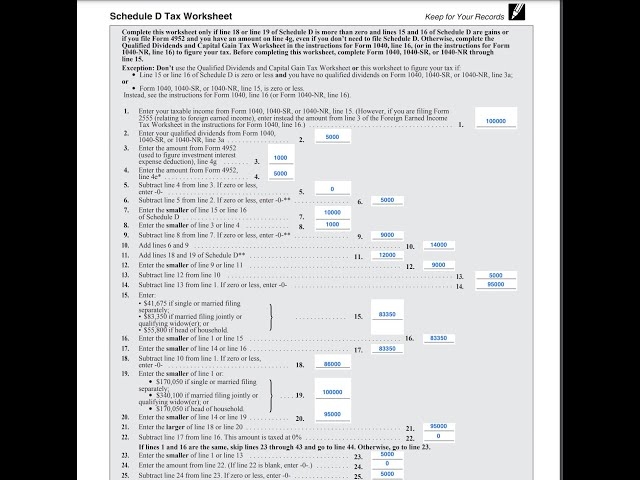

Schedule D Worksheet

The Schedule D Worksheet is a form used by individuals to report their capital gains and losses from investments such as stocks, bonds, mutual funds, and real estate. This form is essential for calculating the net gain or loss from these investments and determining the amount of tax owed on these transactions. It consists of several sections, including Part I for short-term capital gains and losses and Part II for long-term capital gains and losses.

When filling out the Schedule D Worksheet, it’s important to gather all relevant documents, such as brokerage statements, dividend statements, and records of any sales or exchanges of investments. You will need to provide detailed information about each transaction, including the date of purchase, date of sale, purchase price, sale price, and any associated expenses or fees.

After entering all the necessary information, you will calculate the total gains and losses for both short-term and long-term investments separately. The worksheet will then help you determine the net gain or loss by subtracting the total losses from the total gains. This final figure is what you will report on your tax return.

It’s important to double-check all calculations and ensure that you have accurately reported all your investment income on the Schedule D Worksheet. Any mistakes or omissions could result in penalties or additional taxes owed. If you’re unsure about how to fill out this form correctly, consider seeking the assistance of a tax professional or financial advisor.

In conclusion, the Schedule D Worksheet is a vital tool for individuals who need to report their capital gains and losses on their tax returns. By understanding how to fill out this form accurately and thoroughly, you can avoid potential errors and ensure compliance with tax laws. Make sure to keep detailed records of all your investment transactions and seek help if needed to ensure a smooth tax-filing process.